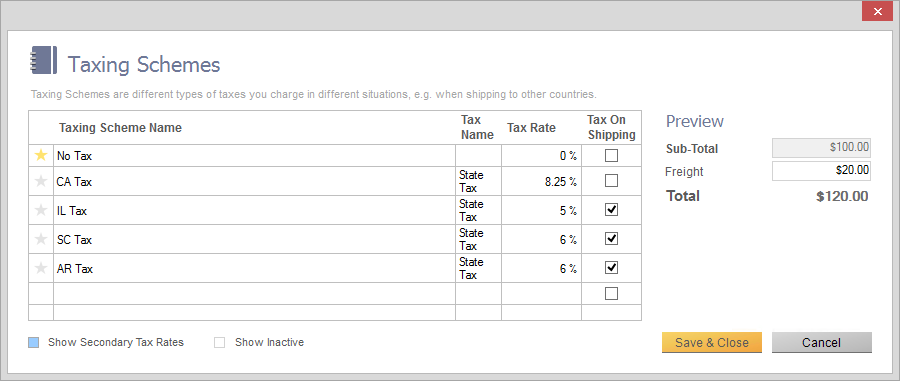

Taxing schemes calculate your taxes when completing Sales and Purchase orders. In the Settings window, on the Company tab you will find the Manage Taxing Schemes button which will let you set up your taxes.

To set up a new tax:

- Click the Main Menu > Options > Settings.

- Scroll down to the Taxes section and click the Manage Taxing Schemes button.

- Give your taxing scheme a name, provide your tax name(s) and percentage(s).

- Click Save & Close.

You may want to select your tax as the default scheme. This tells the program to charge that tax on all new orders going forward (unless the vendor or customer has their own default scheme).

To do so, click the star next to the taxing scheme you want to set as the default.

Looking for more info?

Here are some other things you can do with taxes in inFlow: