Special Tax Rates are used to apply different taxes to items on the same order. They are specific to the product and can be set up so that each item is taxed differently (i.e only Secondary taxable, or only Primary taxable, etc).

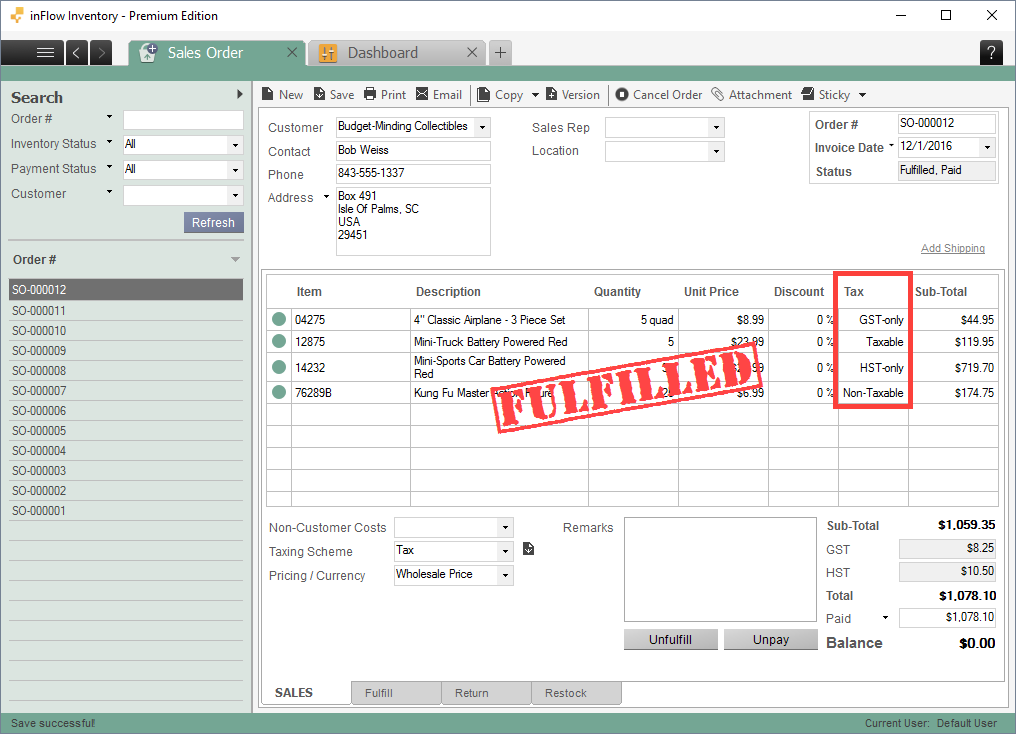

By turning these on you will see an extra column in the sales order window that shows which items on your order are being taxed.

Setup

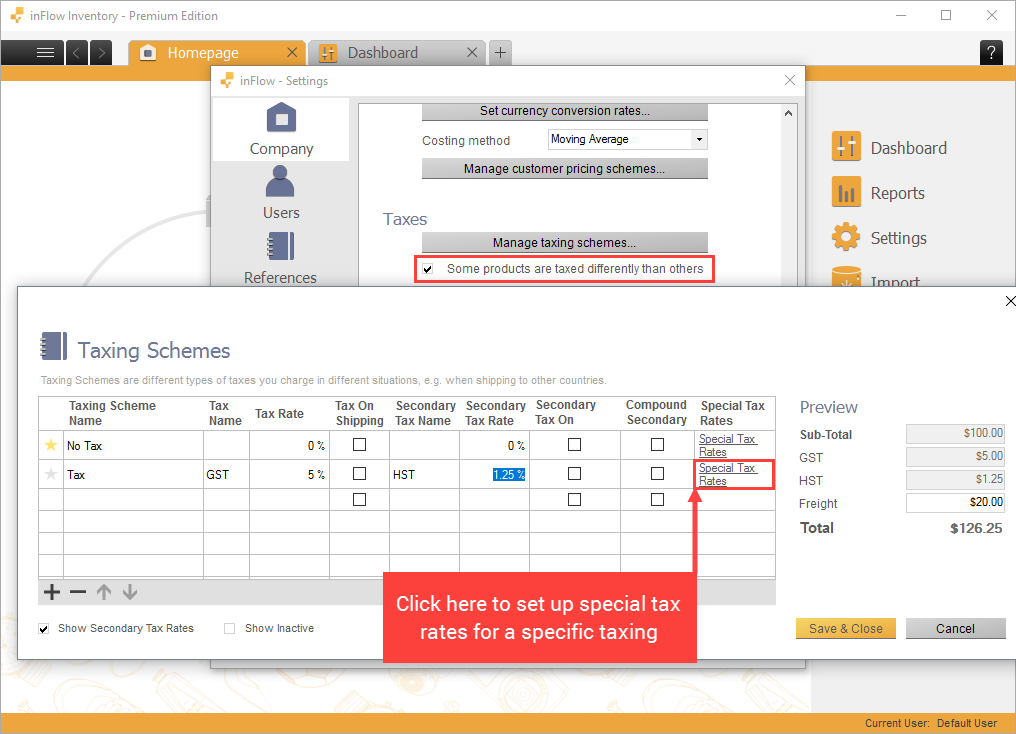

To turn on Special Tax Rates:

- Click Main Menu > Options > Settings.

- In the Company tab, scroll to the Taxes section.

- Check the box: Some products are taxed differently than others.

- Click the Manage Taxing Schemes button above the checkbox.

This will open a new window where you can set the taxes. In this window you can set up special tax rates for specific taxing schemes.

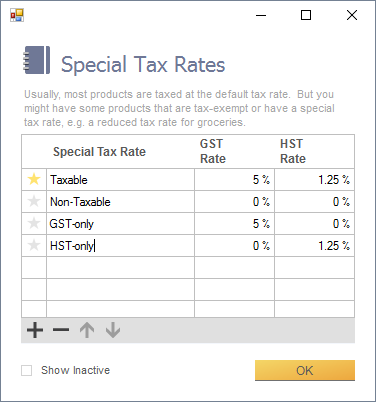

Create the tax rates you want, specify the percentages and then click “OK”.

For example, we have set the GST to be 5% and HST to be 1.25% . Some products are GST-only so we have set the HST rate to 0% and vice versa.

Click OK, then Save and Close when done.

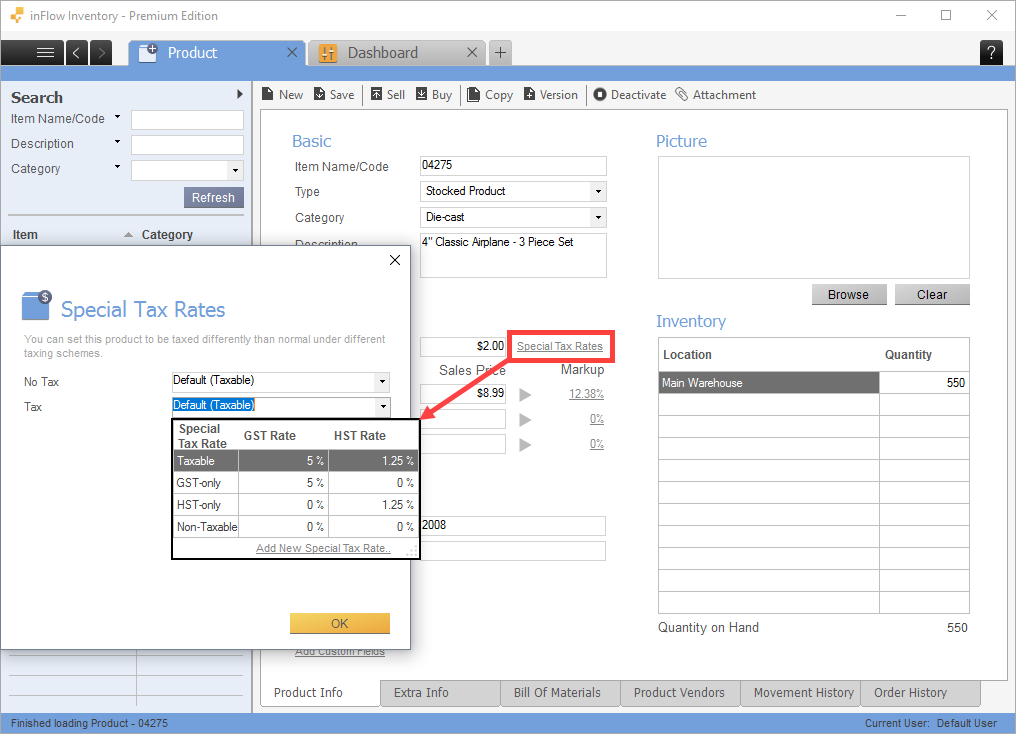

Product Tax

In the product record you can click Special Tax Rates button, next to the Cost and Price section. This will indicate which rates apply to it by default.

For example, if the above product should not be taxed at all, set Non-taxable to all settings for this product.

Once you’ve finished updating the settings for each product, you can now add them to the same order and the tax will be applied accordingly.