NOTE: The following are steps for a workaround for older versions, it doesn’t work as well as our new feature now available as of v3.4. You can see the new tax inclusive pricing feature here.

You may need to show your product price (including tax) in the body of the invoice but show the taxes applied at the bottom. If you’re still using an older version of inFlow, here’s a suggestion that you might be able to use to set up the taxes included.

Let’s look at a pair of shoes which are priced at $50.00 AUD but to show what tax is included you will apply a negative tax as well as a positive tax (so that your total isn’t ultimately affected).

To do so:

- Go to Main Menu > Options > Settings. Scroll down until you see the “Taxes” section.

- To edit your taxes click the Manage Taxing Schemes button.

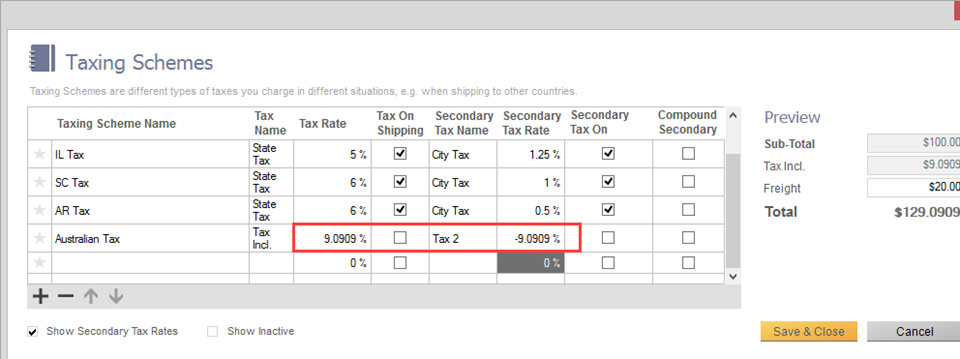

- In this window you will set up a taxing scheme where the first tax is a negative and the second is a positive percentage (as indicated below).*

*There, however, a trick to setting this up since in the case of this percentage, the math works out such that it is not the same as the sales tax you will be charging. To that end you will need to enter 9.0909% instead of 10% as shown above.

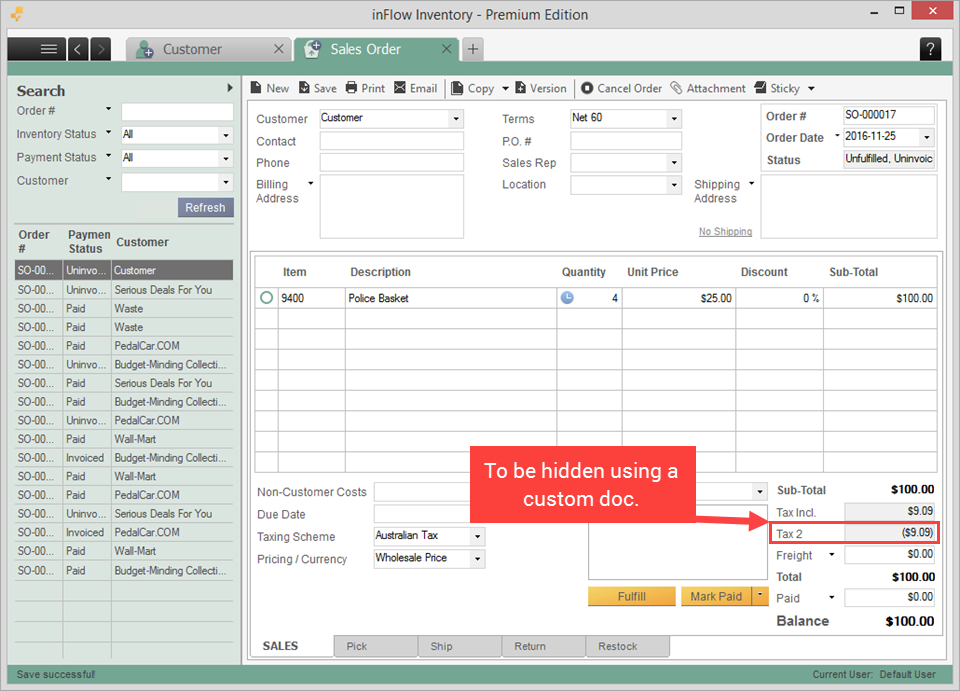

The second stage of set up involves setting up a custom document and you can create a custom document that shows only the positive tax next to “Tax Included”. This way, your final invoice shows the tax included prices and the amount of tax included, as below:

In this case, as above, you can see that there was $5.00 of tax included in the posted retail price of the shoes but the price is not reduced in the body of the invoice. By using this method you can show your customer the price they were quoted while still including the necessary tax notation below. Keep in mind that you will see the second tax within the program and on the in-program documents so it’s important to use a custom document to remove this additional info.

We’ve prepared a sample custom document that works this way. You can download it at

http://www.archonsystems.com/support/tax_included_receipt.doc . Follow these instructions to import this as a custom document into inFlow and try it out.

Were you looking for a way to include the pre-tax price on your order? If so please see here.