If you need to show your price before tax in the body of the receipt (as in the UK) but don’t want to have to calculate all your pre-tax prices by hand, inFlow On-Premise can do that for you.

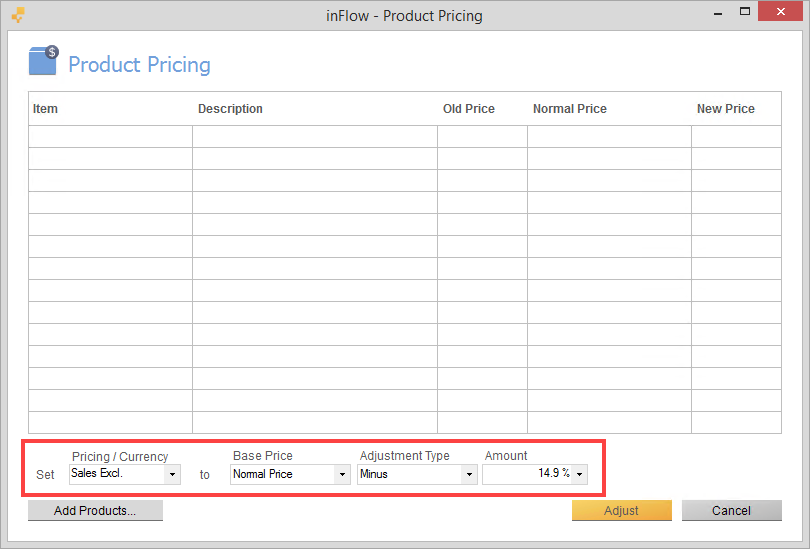

First, set up a pricing scheme for the pre-tax price:

- Add your prices as posted to the program under a Taxes Included scheme, let’s call this scheme Normal Price.

- Go to the Main Menu > Inventory > Product Pricing.

- Click Add Products and select everything.

- From the Pricing/Currency dropdown choose <Add New..> and create a new pricing scheme; called “Sales Excl”. Click Save & Close.

- Next we have to calculate the percentage by which your prices should be reduced (since it’s not the same as your tax percentage). This is done using the following formula: OriginalPrice = PostedPrice * [1 / 1+SalesTax] For 17.5% sales tax the calculation (for example) would be as follows: £8.99 * [1 / 1 + 17.5%]. This would work out to the original price being £7.65. This also tells us that the original price (pre-tax) was 85.1% of the posted price, meaning that we will need to reduce our prices by 14.9% in order to get the correct pre-tax prices.

- To set your PreTax Price scheme correctly, tell inFlow at the bottom of the window to: SET “SALES EXCL” TO “NORMAL PRICE” “MINUS” “14.5%”.

- Click Adjust to apply the changes.

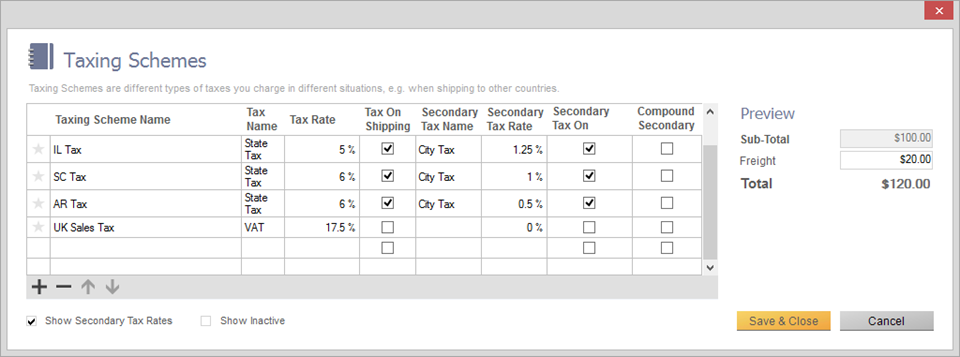

When you’re done, set up taxes to calculate:

- Go to Main Menu > Options > Settings.

- Scroll down to the Taxes section and click Manage Taxing Schemes.

- Set up a 17.5% sales tax in this window and give it a name.

- Click “Save & Close“.

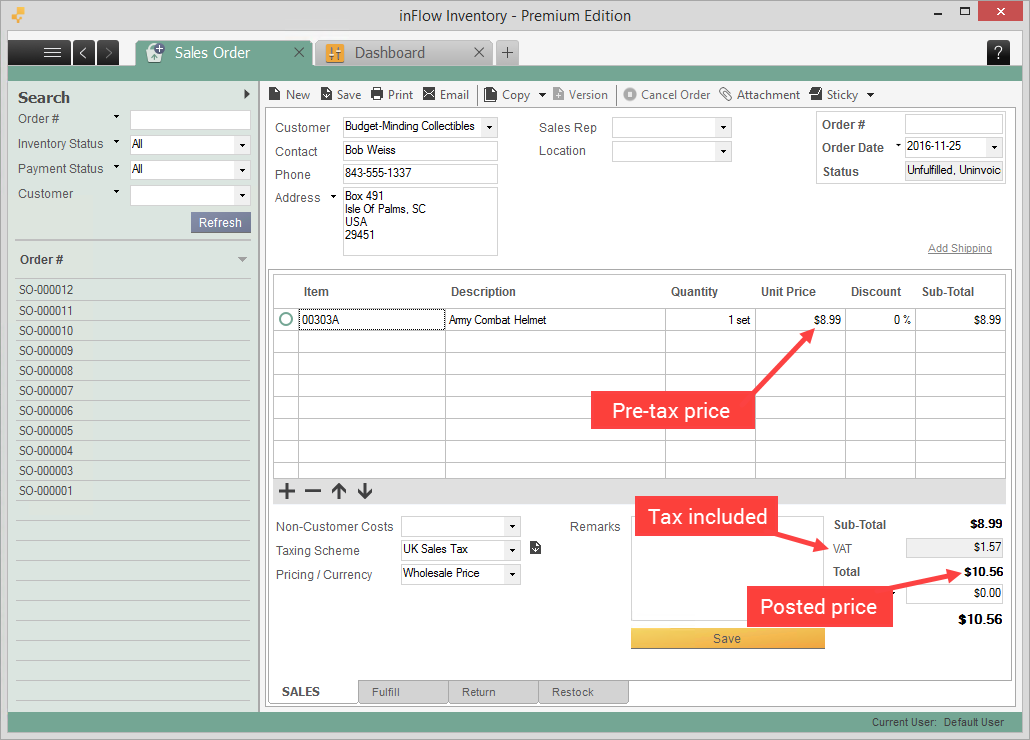

Your sales order would finally look like this:

Were you looking for a way to show the product’s tax included price on your order? If so please see here.