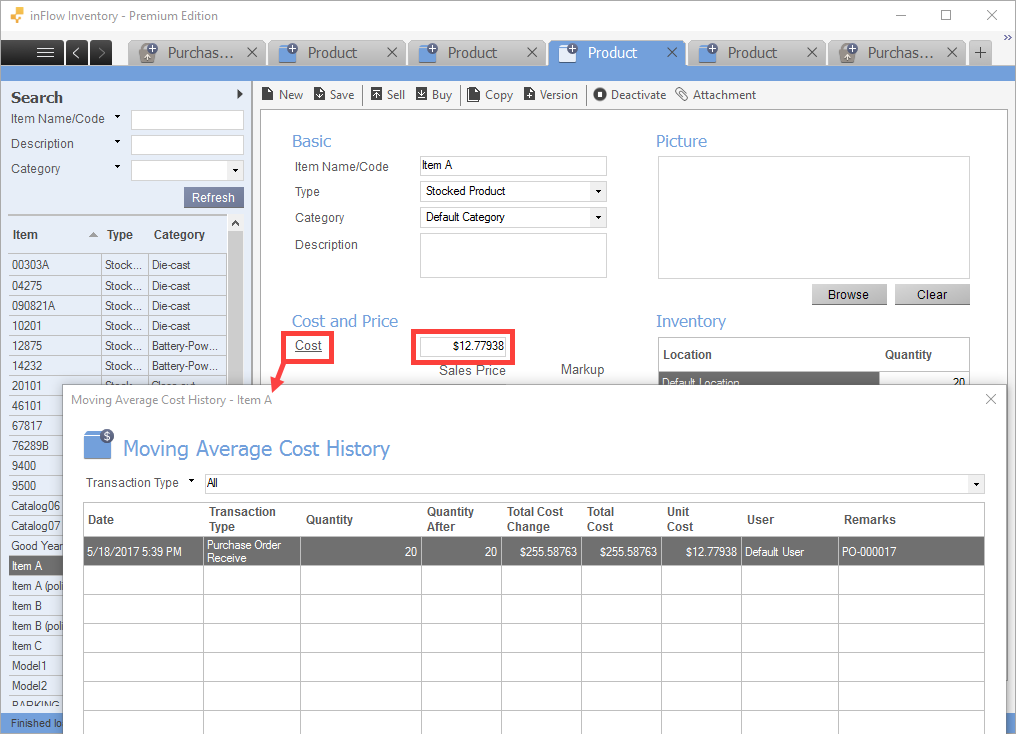

If you’re using the FIFO, LIFO, or Moving Average Cost costing method in inFlow, you may be wondering how the program calculates your item’s unit cost in a purchase order and what factors are involved.

The cost of an item as it enters your inventory (through a purchase order or work order) includes the following factors:

- vendor unit price (includes any discounts)

- shipping fee/ freight

- any non-vendor costs

- service items in the purchase order

- cost of component items (work orders)

NOTE: inFlow does not include any taxes on the purchase order when calculating the cost.

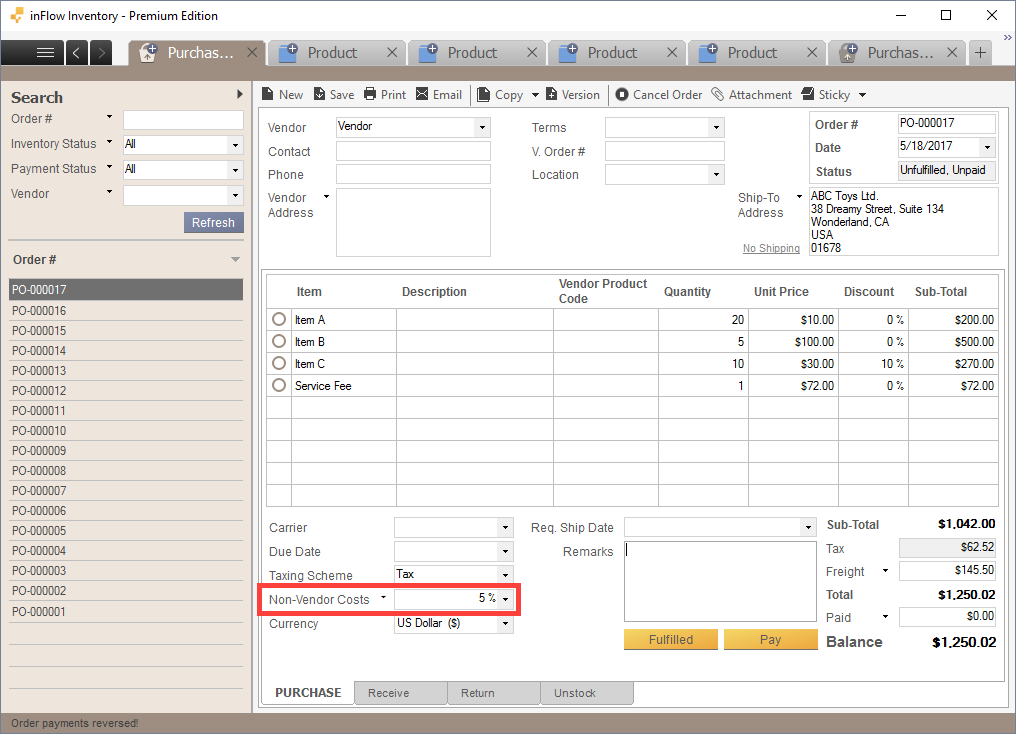

We’ll use a sample purchase order to help illustrate what the above factors refers to in detail (click on the images to zoom in).

Vendor Unit Price

You can find the vendor unit price in the Unit Price column in the purchase order. However, if the item has a discount, then that will also be included in the calculated amount, even though the unit price information doesn’t change.

To get the unit price for each item:

Item Subtotal ÷ Item Quantity = Unit Price

Following the example purchase order above… you would get the following values:

Vendor Unit Price (incl. discount)

Item A: $200 ÷ 20 = $10

Item B: $500 ÷ 5 = $100

Item C: $270 ÷ 10 = $27

The Unit Price is used in the following calculations as well.

Freight

If your vendor is charging you freight / shipping fees, you can input that in the Freight field in inFlow (just before the order total).

If you don’t see this field at all in your purchase order, you’ll need to click the Add Shipping button at the top right of your order.

inFlow takes the amount in the Freight field and distributes it across all stocked items on the purchase order. This distribution is weighted and it depends on the unit price of the item.

To get the freight value for each item:

Unit Price ÷ [Sum of Stocked Products subtotal] * Freight Total = Freight (unit)

Following the example purchase order above… you would get the following values:

Freight (unit)

Item A: $10 ÷ [ $970 ] * $145.50 = $1.50

Item B: $100 ÷ [ $970 ] * $145.50 = $15

Item C: $27 ÷ [ $970 ] * $145.50 = $4.05

Non-vendor costs

If you need to pay any duties/ import fees / tariffs, you’ll need to record this under the Non-Vendor Cost field in inFlow (bottom left of the purchase order). These charges should be added only if the payment isn’t going to your vendor. Any extra fees that require you to pay your vendor should go in either the freight field or as a service fee on the order itself, not non-vendor costs.

To get the non-vendor cost value for each item:

Unit Price ÷ [Sum of Stocked Products subtotal * [Non-vendor Cost % * Order Subtotal] = Non-vendor cost (unit)

Following the example purchase order above… you would get the following values:

Non-vendor cost (unit)

Item A: $10 ÷ [ $970 ] * [ 5% * $1042 ] = $0.53711

Item B: $100 ÷ [ $970 ] * [ 5% * $1042 ] = $5.37113

Item C: $27 ÷ [ $970 ] * [ 5% * $1042 ] = $1.4502

It is also possible to input a dollar value instead of percentage for the Non-Vendor Cost. In this case, it would be:

Unit Price ÷ [Sum of Stocked Products subtotal] * [Non-vendor Cost ($)] = Non-vendor cost (unit)

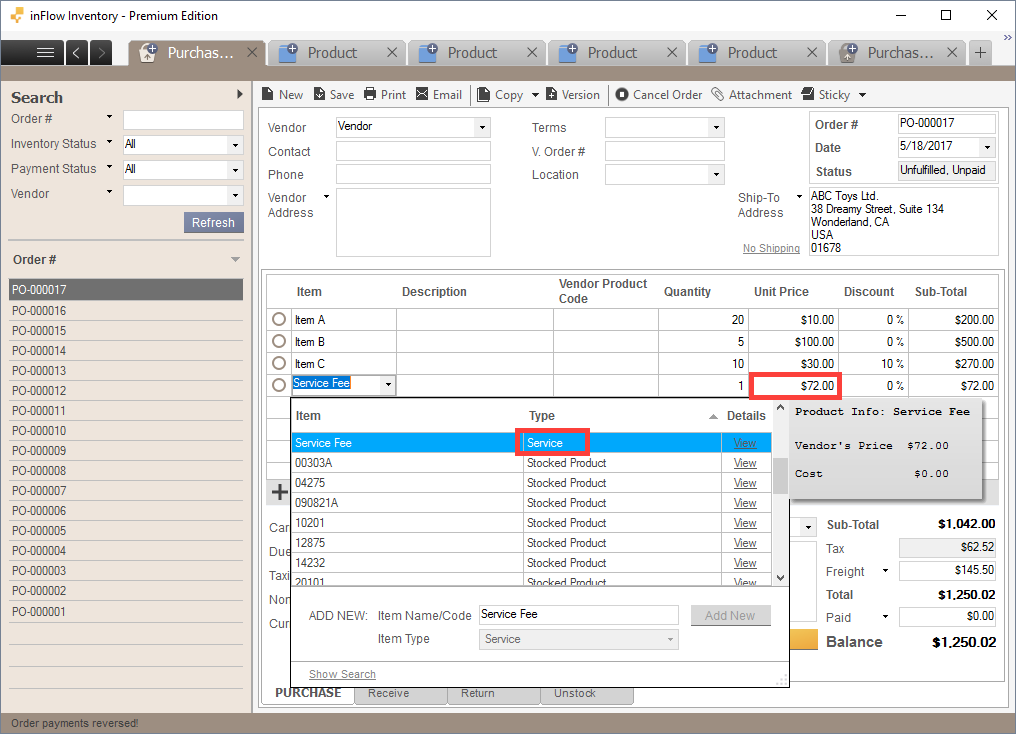

Service items

If your vendor also charges a service fee (e.g. polishing, engraving, machining, etc) separately, inFlow adds the service fee to the calculations as well. You would have this included in your purchase order as a service-type item.

inFlow will add the service fee to each item’s cost. So, you may want to make two orders so that the service + related items are separate from the other non-serviced items.

Let’s say you bought some items from your vendor but only one item has an extra fee for polishing. If you include all items, then the polishing service fee will be applied to each item (including the ones that weren’t serviced).

To get the service value for each item:

[Unit Price ÷ Sum of Stocked Products subtotal] * Service Total = Service cost (unit)

Following the example purchase order above… you would get the following values:

Service cost (unit)

Item A: $10 ÷ [$1042 – $72] * $72 = $0.74227

Item B: $100 ÷ [$1042 – $72] * $72 = $7.42268

Item C: $27 ÷ [$1042 – $72] * $72 = $2.00412

Phew! That’s a lot of math … aren’t you glad inFlow is doing this calculation for you? Adding them all together will give the cost that inFlow uses for your profit calculations:

$10 + $1.50 + $0.53711 + $0.74227 = $12.77938

We’ve included a final image here of Item A’s unit cost as calculated by the program: