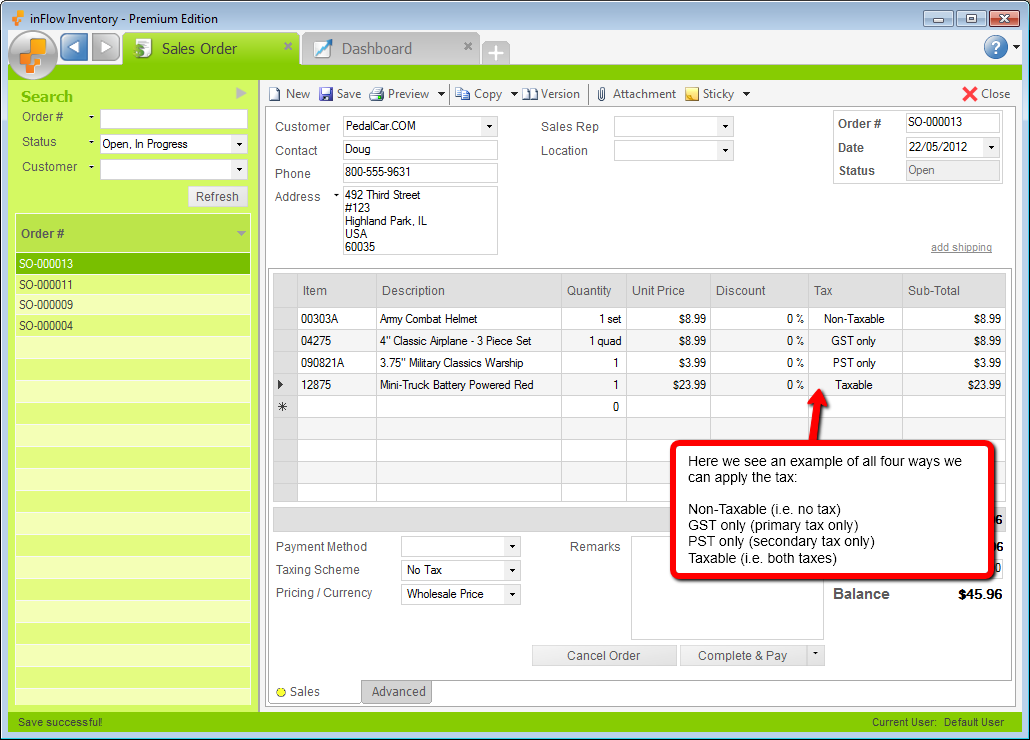

You can charge tax on some items and not others by using your Product Tax Codes to show which items should be taxed. By turning on your product tax codes you will see an extra column in the sales order window that shows which items on your order are being taxed.

To turn on Product Tax Codes:

- Click the Main Menu > Settings > General Settings.

- Select the Pricing & Tax tab.

- Check the Show Product Tax option.

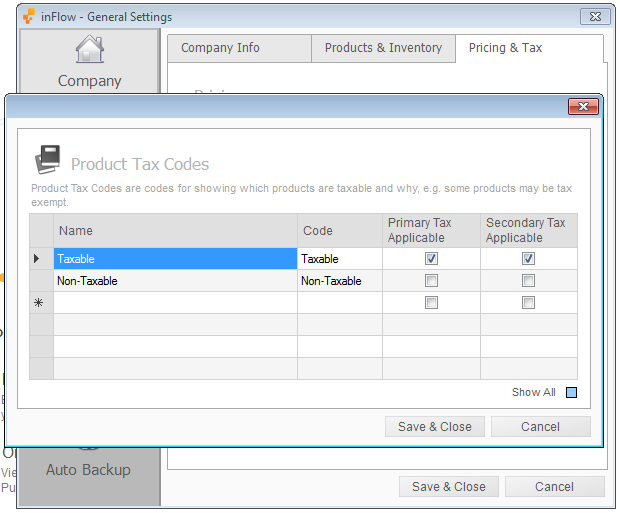

To edit your Product Tax Codes:

- Click the Main Menu > Settings > General Settings.

- Select the Pricing & Tax tab.

- Click the Edit Product Tax Codes button.

- In this window you can set up different types of products (i.e. non-taxable vs. taxable etc.)

- Click Save & Close.

- Click Save & Close in the General Settings window.

In the product record you can set the items tax code to indicate which tax to apply to it when adding it to an order. In the example below we’ve included one of all four ways that you can set up the product tax codes: